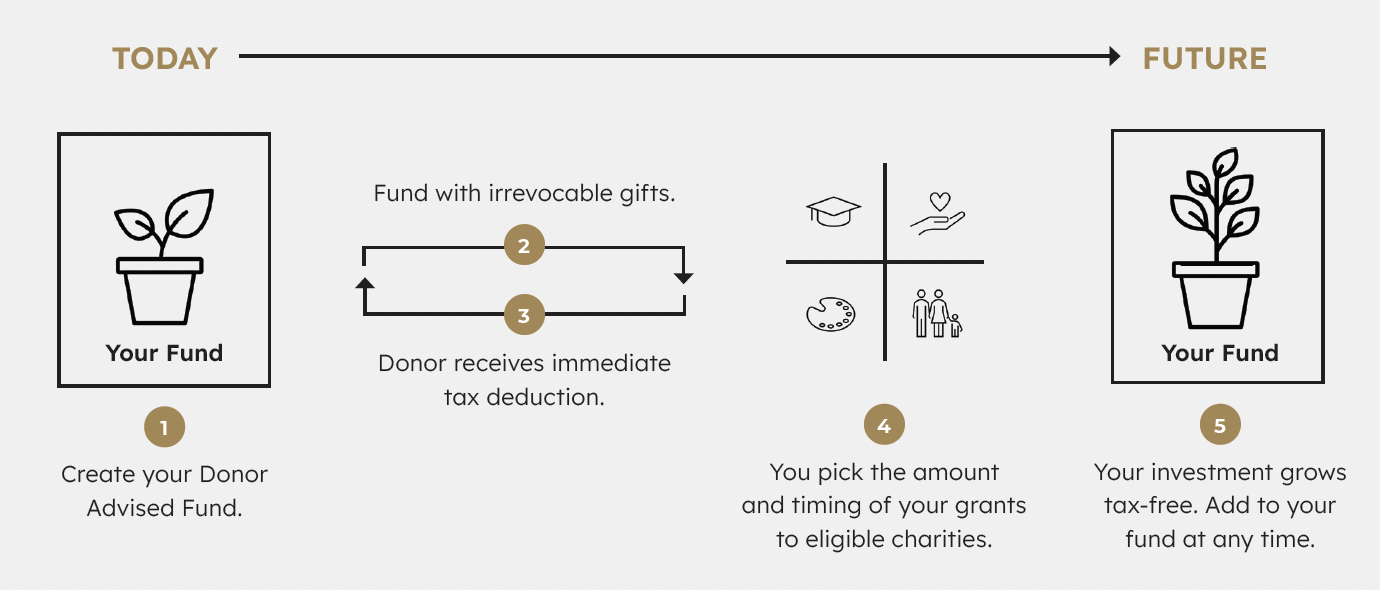

A Donor Advised Fund (DAF) is a charitable giving account designed to invest, grow, and give assets to charities. DAFs minimize the worries and administrative burdens of grantmaking, so you can focus your time and energy into what really matters: making a meaningful and lasting impact with your giving.

ASSETS GENERALLY ACCEPTED

- Cash Equivalents

- Publicly Traded Securities

- Restricted Stock

- Mutual Fund Shares

- Bitcoin and Other Cryptocurrencies

- Private Equity and Hedge Fund Interests

BENEFITS OF A DONOR ADVISED FUND

- Choose if you would like recognition or anonymity for your donations

- No annual minimum distribution requirements, unlike private foundations

- Your assets grow tax-free and provide you with more dollars to grant to charity

- Streamline your tax prep with fewer charitable donation receipts to manage

- Eliminate capital gains tax on long-term appreciated assets, as long as they’ve been held for more than a year

- Maximize tax benefits

WHO SHOULD CONSIDER A DONOR ADVISED FUND?

Donors who want a simple and efficient way to manage their giving with the flexibility to support multiple charities over time. A Donor Advised Fund may also be appropriate as an alternative to a private or family foundation and allows for the option to gift anonymously.

How It Works

The tax and foundation planning information offered is general in nature. It is provided for informational purposes only and should not be construed as tax or legal advice. You are encouraged to consult an attorney or tax professional regarding your specific tax and legal situation.